-

Posts

2016 -

Joined

-

Last visited

-

Days Won

31

Content Type

Profiles

Forums

Articles

Posts posted by dman748

-

-

4 hours ago, tyrannical bastard said:

In general, since WBNS has always been a leader in it's field, and now it's just another corporate clone.

However, regarding the corporate mandates, I'm sure the stations have the levity just because of the uncertainty of Tegna's future ownership at this time...

That makes sense about the "meh" part of the post. I'm pretty sure behind the scenes 10TV did NOT want the Tegna package at all.

For some reason @jbnews it's not letting me quote your post when I go into edit posts (not sure why) but what's seems to be the most probable outcome for Tegna is that they'll likely try to accept whoever can exceed $20 a share (e.g. Gray making a $21 or $22 a share offer or something like that) the other option for Tegna is that say neither 3 budges north of $20 a share because of the market conditions rather than Tegna saying that they're not going to sell they'll look at and see who would be the better fit for them. (And I would prefer to save that part of the discussion for one of the Tegna merger discussion threads most likely the Speculatron thread since this more than likely is in that territory)

-

5 minutes ago, tyrannical bastard said:

WBNS = Bleh.

If it wasn't for the total disaster up north at WKYC, I'd be more devastated. That alone makes the average Tegna-fication tolerable to some extent.

Are you referring to the graphics or just the way 10TV is handling things with using the Tegna package for everything but Face The State? If it's the latter then that "may" have confirmed just about everything that's creating the uncertainty at Tegna's HQ at the moment and maybe perhaps WBNS knows something that we don't.

-

Meanwhile Aerial is still alive at 10TV, it's still in use for their Sunday Morning Political show, Face The State

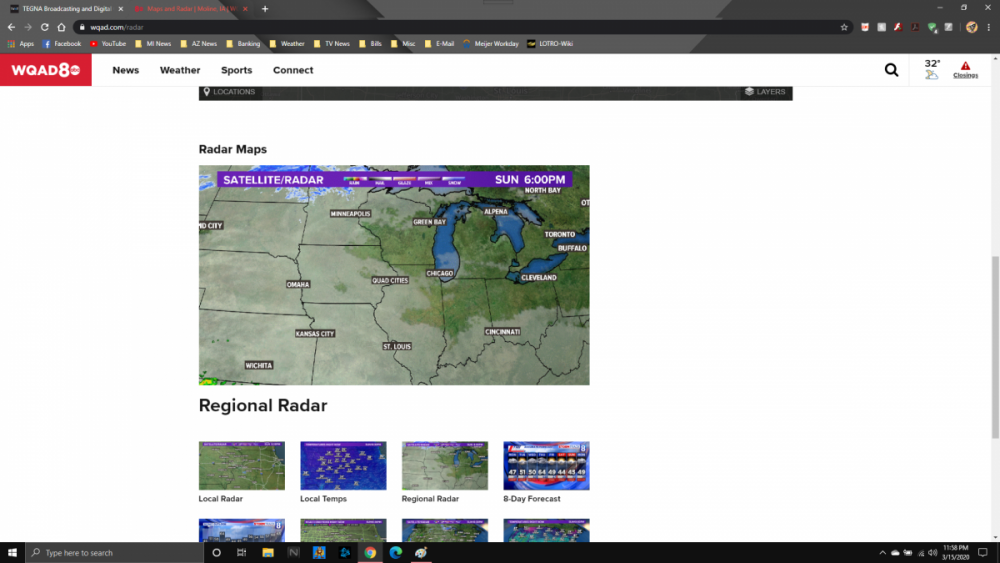

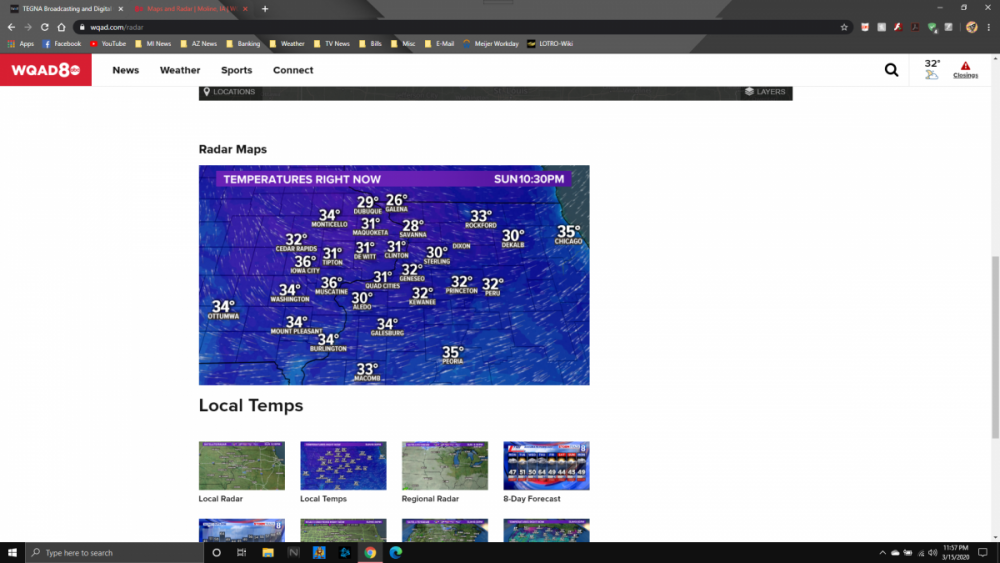

1 hour ago, MichiganNewsGraphicsJunkie said:I checked the WQAD website and I saw the Tegna package so it is coming to WQAD (it wouldn't surprise me one bit to see WQAD fully Tegnized before the May sweeps period begins)

-

1

1

-

-

23 hours ago, MichiganNewsGraphicsJunkie said:

I am assuming that WQAD is next to be TEGNA-fied... Looking on their website tonight, even though on air, they have Tribune graphics, most of the weather maps online are TEGNA-fied

I was just looking at the WQAD website I couldn't find the weather graphics that you're talking about, from what I saw they were still using the Tribune package for Weather.

On 3/13/2020 at 4:11 PM, oknewsguy said:So now Standard General has made a proxy statement, still looking for 5 seats on Tegna's board and are asking other shareholders of Tegna to elect those 5 people to the board. https://www.broadcastingcable.com/news/standard-general-files-tegna-proxy-statement

Things are still evolving and developing, I think there's going to be additional movement to this with other companies joining Gray, Apollo (Cox) and Allen in the bidding war for Tegna in order to prevent Soo Kim from taking over Tegna.

Stay tuned folks.

I keep forgetting to update the Standard-Tegna situation so here's the follow-up on that.

In addition to filling the proxy statement, Standard has nominated 2 other people besides Deb McDermott and Larry Wert (which has been mentioned previously in this thread) they are Colleen Brown and Ellen McClain Haime.

So Standard General is continuing to put pressure on Tegna as more companies make offers for the 62 TV stations which puts Tegna in a situation that they can't get out of no matter what.

-

So now Standard General has made a proxy statement, still looking for 5 seats on Tegna's board and are asking other shareholders of Tegna to elect those 5 people to the board. https://www.broadcastingcable.com/news/standard-general-files-tegna-proxy-statement

Things are still evolving and developing, I think there's going to be additional movement to this with other companies joining Gray, Apollo (Cox) and Allen in the bidding war for Tegna in order to prevent Soo Kim from taking over Tegna.

Stay tuned folks.

-

WBNS 5pm Open (using the oohs and ahhs in the cut):

-

6 minutes ago, GoldenShine9 said:

I wonder if others step in, like Scripps? Also stock prices will likely recover after the COVID-19 crisis ends.

I wouldn't be surprised if more joins in, while I do agree that the stock market may recover once COVID-19 goes away (if it does) however if Tegna really has to make a deal it's just going have to take bids like Apollo's and Allen's, normally a bid like Gray's would've been fine but right now with the stock market is shaping up it's not.

One way or another I see a sale of Tegna coming soon regardless of where the Stock Market and COVID-19 stands.

-

1

1

-

-

For those that are saying that no M&A's should take place right now. If I were Tegna I would seriously take the Apollo and Cox bids very seriously based on this quote

QuoteAllen’s offer represents a significant premium to the current price of Tegna shares, which have been buffeted like other media stocks (and just about all stocks) by the market’s recent slump. Tegna closed down 8% Wednesday at $16.02. The volatility, due to deepening fears of the coronavirus pandemic, may make an all-cash offer particularly attractive.

Also I should note that the New York Times made a deal with Oak Hill (which formed Local TV) in 2007 (at a time where the Economic Downturn was just beginning) and I'd be $100 that particular deal was an all-cash deal as well.

It's just the way any M&A in general is going to have to take place until the Stock Market stops the sell off and COVID-19 goes away and thus Gray is going to have to adjust it's bid and go with the flow if they want to stay in the race because right now I believe Apollo and Allen have the advantage in the race for Tegna over Gray.

The key takeaway here is that just because the stock market is down doesn't mean a deal can't be made it's just that the only gurantee way you're going to win in this bid for Tegna is by going all cash. Cash and Stock won't help in this deal where in the past it has. (especially with the stock part)

-

Just now, kfc513 said:

You know what else got lost?

They also got the Tegna graphics: https://youtu.be/AeFsLjpr9S0

And WQAD may be next because they're a different logo on their website right now.

It was actually mentioned I believe a couple of pages back in this thread.

But at the time, KFSM was still on the Tribune website layout.

So KFSM becomes one of only 2 Tribune/Nexstar rejects to have been completely Tegnized. Technically WNEP is the other one (even though they don't use C Clarity yet)

Outside of those 2, they've all switched to the Tegna layouts but are still running either the Tribune package (WTIC, WPMT, WQAD) or the Nexstar package (WOI/KCWI, WATN/WLMT, WZDX)

-

-

On 2/27/2020 at 11:07 AM, TexasTVNews said:

Tegna Media and Gray Television strike strategic OTT Partnership.

On 3/6/2020 at 9:29 AM, CLETVFan said:Isn't that ironic that Gray and Tegna enter into an OTT partnership and then just over a week later Gray wants to buy Tegna for $8.5 billion?

I'm starting to wonder if it was just coincedental or is it something else.

-

2

2

-

-

9 hours ago, rkolsen said:

They flew in a helicopter from (formerly of WCPO N90CL) from St. Louis within 14 hours of the hurricane.

Don't you mean the tornadoes? Last time I checked we're not in Hurricane season yet.

-

1

1

-

-

6 hours ago, tyrannical bastard said:

Sooner or later, this bubble is going to burst. The escalating cost of sports on TV coupled with the people dropping traditional pay tv in droves is coming to a tipping point. At some point it will hit the leagues themselves when the TV coverage falls when people either can't access the programming or they don't want to pay for it.

The day the RSN business model collapses is going to have people like myself laughing at Sinclair not for their politics but because of the things I've said more than once and what @channel2 said last night on here about the lack of TV stations Sinclair can bundle the RSNs with (e.g. Sinclair doesn't have any TV stations in places like LA, Chicago, Atlanta and Miami that Sinclair can bundle the RSNs with) sure Sinclair can bundle Fox Sports Oklahoma with KOKH/KOCB but you're not going to bundle Fox Sports Wisconsin with WVTV.

There are lots of factors that are playing a role in the demise of the RSNs I just think Cord Cutting is not the only issue here.

-

1

1

-

-

4 minutes ago, TheRyan said:

Well if things keep going in this trajectory, I would personally recommend Sinclair does something to offload its debt (whether that's selling some of their ownership stake or something else).

But my gut feeling is that all will work out fine for Sinclair once the dust settles on the rebranding strategy and what happens to the programming at-large on the RSNs.

As I've been saying for the last month on other platforms outside of here, Sinclair can survive this storm if they want to and have a plan in place for a rebrand on the RSNs and things like that if they can cut out their incompetancy that they currently have (which they can do IF they choose to do so)

-

1

1

-

-

17 minutes ago, channel2 said:

Sinclair is massively in debt. Something like $14 billion? Their financial statements are a bit opaque and confusing.

Evidently they don't know how to do a leveraged buyout properly, since they didn't seem to put any of that debt onto Diamond. Not sure that would have been responsible per se, but it would have sheltered Sinclair proper from a lot of the seemingly-inevitable fallout.

If Sinclair was smart to have done this they would've been able to protect more than just the RSNs they would've protected other non-sports assets (such as local TV stations as well)

But of course, we're dealing with an incompetant CEO in Chris Ripley who seems to have no idea what the heck he's doing here.

-

35 minutes ago, tyrannical bastard said:

PBS seems to be the same way, more zip-code based rather than DMA.

I had access to Fox Sports South and Southeast, and now both are gone.What kind of rhyme and reason is dictating what RSN's are going away? Are the teams involved along with the Sinclair/Byron Allen arrangement?

I feel like Rupert walking away from the RSN business had some to do with this. I think though it's on Sinclair's stubborness, Chris Ripley's arrogance and most of all Sinclair wanting to overcharge for these RSNs (prime example Sinclair is asking distributors $6.50 for Marquee. No that's not a typo that's what Sinclair is asking these distributors in the Chicagoland region to carry Marquee) and at the end of the day I can't blame Comcast for wanting to say no to that and I don't think that lowering the costs of carrying these RSNs is going to help things either for Sinclair because remember, companies like Sinclair are in the business of making money not lose money.

Now that I think about it Sinclair is lucky this year is an election year because unless they get their act together they're in deep and I mean DEEP trouble for 2021 and beyond and there could very well be consequences for more than just the RSNs.

P.S. I'm surprised no one has even asked this question but how much is Sinclair asking these distributors to pay for these FSNs compared to when Fox owned the RSNs?

-

1

1

-

-

3 hours ago, CubsFan79 said:

Could Sinclair's RSN be pay per view only?

The RSNs going to PPV only is a bad idea. That would people like me out of reach from watching live sporting events (and it doesn't help that leagues like MLB have these blackout policies that would prevent us baseball fans from watching games on channels like MLB Network)

If anything I cant see Sinclair making the RSNs a direct-to-consumer option (which sounds more feasible than making the RSNs PPV-only)

-

On 3/3/2020 at 2:48 PM, A3N said:

So it seems like they're very slowly de-emphasizing the FOX Sports brand on air. Some of the graphics (Top/Bottom inning recap/L3's) are not showing FOX [team logo] on them.

Also heard a promo for college basketball but the voiceover did not say FOX Sports San Diego at the end, even though the Fox Sports logo appeared on screen.

I've noticed that the FOX (insert team name) has started to be scrubbed off slowly during the Oklahoma City Thunder game tonight on Fox Sports Oklahoma, I fully expect to see refrences to Fox Sports get removed more and more.

If I were a betting man I imagine that Sinclair will drop the Fox Sports name in time for the NBA/NHL Playoffs and if not then they likely will by the MLB All-Star Break

-

26 minutes ago, ColumbusNewsFan said:

The Dispatch stations will probably be last because word is they are dragging their feet on this for some reason but it will be in before Fall, before they will finally in my prediction.

I wonder what the hold up is? Is it because WTHR and WBNS decided to join WNEP in the fight to protect their imagery and things that made them so successful for so long or is it something else?

-

2

2

-

-

4 minutes ago, mrschimpf said:

Knowing Sinclair's vexilological kink with the Stars and Stripes, 'Flag' could work

.

.

Flag may actually be very fitting because when you think about it in Sports (especially Football) you have that yellow flag that's ready to be thrown at the moment a foul has been committed.

-

Just now, channel2 said:

They dropped the full name after Chris-Craft bailed, so "UPN" didn't stand for anything.

So maybe perhaps Sinclair may just revert the RSNs from "Fox Sports (insert region/city name here" back to "FSN (insert city/region name here)" and have FSN not stand for anything

-

1 minute ago, 24994J said:

"The F stands for 'you all ask too many f-ing questions'." -Sinclair, probably

Or that it could stand for "F--- anybody asking us about the RSN business model suffering."

5 minutes ago, channel2 said:What did UPN stand for starting in 2000?

Didn't it stand for United? I believe it did

-

5 hours ago, Viper550 said:

I begin to wonder if they could just go back to the name "FSN" but not have the F stand for Fox...

What would that F stand for if it's not going to stand for Fox?

-

2 hours ago, Al-SA-TX said:

I'm not entirely sure. Air Comfort Solutions, the company, is a big spender in advertising. It could be that there was another suitor willing to pay more, so a name change may be on the horizon again. For now, it's just Chopper 4 again.

I'm no longer there, so I can't say for certain.As a side note, Air Comfort Solutions Chooper 4 was a mouthful and I was never a fan of that brand.

Given that they have former OU Quarterback Jason White and of course, Lord Gary England that makes logical sense for ACS to have the kind of money needed to spend the advertising dollars and money needed to sponsor a multitude of things including the Chopper.

When Air Comfort Solutions was sponosring KFOR's chopper it would've been a lot easier to say "ACS Chopper 4" instead of "Air Comfort Solutions Chopper 4" like what they did but that's just me.

.thumb.png.9b989517870a82b650f6df4233e93f8d.png)

TEGNA Broadcasting and Digital General Discussion

in Corporate Chat

Posted

So now the race to acquire Tegna is now coming down to 3 (4 if you count Standard General) hedge fund companies and a former stand-up comedian (Byron Allen).

https://www.bloomberg.com/news/articles/2020-03-17/apollo-allen-maintain-pursuit-of-tegna-after-gray-drops-out